By Victoria Bisset

BBC News

image copyrightGetty Images

image copyrightGetty ImagesIt’s been almost two months since the UK’s post-Brexit free trade deal with the EU came into effect.

Under the new rules, European companies must directly pay UK sales tax, or VAT, on sales under £135 (€155; $190), so they now have to register and file quarterly declarations with the UK authorities.

Other changes include customs declarations and additional paperwork. So how have they adapted so far and what impact have the changes had?

Laurent Caplat, founder of French online food shop BienManger.com

BienManger took its final orders from the UK on 18 December and shipped them before the new rules came into effect on 1 January. It is unclear if and when it will resume service to the UK.

image copyrightBienmanger.com

image copyrightBienmanger.comWe run an e-commerce deli, selling a selection of fine foods from France, Europe and worldwide. Around 20% of our orders come from outside France.

The UK market is not central to our business, but UK customers were looking for these products and happy to find them on our website.

Even in November and December it was kind of blurred in terms of what would happen with Brexit and what the rules would be. Now we’ve heard about the new procedures to send parcels to the UK but it’s still not very clear.

We still have a relationship with some English producers and sell products from England and the UK on our website. And we have customers in England calling to say: “I used to order this product on your website, where can I find it?”

It would be a pleasure to start reselling to the UK but we need to spend more time to better understand the changes and cost involved. The question we have is, is it worth implementing all of these solutions for the small amount of business we were doing with the UK?

From my perspective it’s hard to have an opinion on Brexit: everyone will adjust and adapt. I just regret that we used to have this free market and it was so easy to do business all across Europe, and now it’s more difficult.

Thomas Leppa, co-founder of Finnish online wall sticker design company Made of Sundays

The company was established around three years ago and has continued to sell to the UK since Brexit.

image copyrightMade of Sundays

image copyrightMade of SundaysWe are a very small business but around 20% of our exports go to the UK.

The biggest practical thing has been the confusion among customers. Many do not understand how the system works: people think if they order above £135 they do not have to pay tax at all, so then we have to explain that the more you buy, the more you have to do yourself.

With purchases over £135, the customer is responsible for paying VAT once the product arrives in the UK.

With online shopping nowadays people expect free shipping, but with Brexit it’s fairly expensive and those costs have to be paid for. When you use a courier service, they have to do customs declarations and that’s around €5 (£4.30) added cost for each package.

What I don’t know yet is how complicated the tax declaration to the UK is, and how much work that is. Luckily a big part of our UK sales go through Etsy, the marketplace, and there they add the UK VAT on top of the price.

But the biggest issue for us is our accounting: it’s one more country where we have to check all the taxes and get the sums correct for the Finnish tax authorities. It’s a bit more work in that sense but otherwise it’s been going fairly well, so we haven’t really thought about not selling to the UK – at least for the moment.

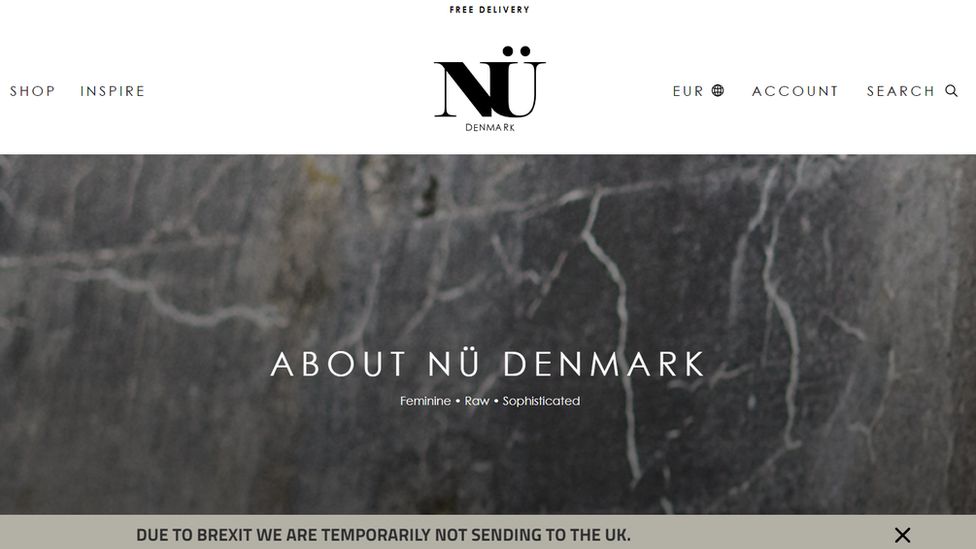

Dorte Randrup, export manager for clothing brand NÜ Denmark

The company faced a month of disruption but deliveries to its UK suppliers have now returned to normal.

image copyrightNu Denmark

image copyrightNu DenmarkI think the UK is the fourth or fifth biggest country we work with.

We managed to send some stock to our distributors in the UK and Ireland before Brexit, then we had around a month or so when we were unable to send deliveries.

We had to wait for VAT numbers to make sure we had everything correct in our system for the new customs regulations but we had a company help us to get it right.

Our distributors in the UK managed contact with customers, but the impact wasn’t too bad because it’s the middle of the season and because of the UK lockdown.

We are able to deliver to the whole of the UK now.

Harald Mücke, owner of German online shop Spielmaterial.de, selling board game components

The company has stopped selling direct to hundreds of individual customers in the UK because of the VAT rule.

image copyrightSpielmaterial.de

image copyrightSpielmaterial.deWe thought about getting a VAT code to be able to send smaller items to the UK but it’s too much work. So we cannot send to private customers in the UK if the order is below £135.

I have some business-to-business clients and they are not affected, but all the small clients are gone. There are something like 400-500 UK customers we cannot serve any more, so it’s causing a loss here.

On orders above £135, it’s much more expensive for all UK clients because they have to pay customs charges and some fees: for example, DHL is charging a fixed fee of €12 per parcel.

I can sell to UK private customers via platforms like Etsy and eBay – then the platform has to collect the UK taxes. But you have to pay an initial fee, which costs money. We have something like 10,000 items so we’d have to pay the fee 10,000 times, and that’s something we don’t want to do. So the customers can’t buy everything.

We also have to update our online shop system to adopt the VAT system and UK shipping costs, which costs several thousand euros. This is the only country in the world handling taxes in this manner and that’s the main problem. It’s an individual thing done by the UK and nowhere else in the world.

Bal Loyla, owner of online Eastern European grocery store Europa Fresh, UK

The company launched shortly before the first UK lockdown in 2020 but has now suspended deliveries to Northern Ireland and Europe.

We’re still growing as a business, but right now that’s been stifled.

The idea was to start exporting more: we know the customers are out there and we get a lot of enquiries. But it’s something we’re going to have to put on the back burner until things become easier or clearer.

We’ve been advised by the couriers that they’re no longer carrying food to Northern Ireland.

Then with Europe we’re having a lot of issues with orders because there’s a lot of paperwork involved. You have to detail every single product that’s in the order – sometimes our orders have anything up to 50 to 100 items and that takes too much time.

We’re only a small business so it’s not worth the headache.

We used to import ourselves from wholesalers in Europe but now we have to use companies here in the UK. One supplier we had in Germany is now using a customs broker and the cost is added to each delivery, so it’s no longer worth it for us to import from them – I think they’re adding an extra €200 on top of delivery charges and product costs.

Our margins are almost cut in half because we have to pay the middleman, whereas before we could import and save. Unfortunately we have to pass the extra cost on to the customers.

We’re only seven weeks into Brexit and prices have gone up, but it’s difficult to say at the moment exactly how much that’s going to affect us long term. I think there needs to be a lot more guidance for smaller businesses like us.

Related Topics

from WordPress https://ift.tt/3bkyGas

via IFTTT

No comments:

Post a Comment